Four times each year the Spears team selects a set of oil prices for the next 5 years. We then use those oil prices to drive our forecast of drilling activity around the globe. Hundreds of additional factors come into play to craft this forecast, but the price of oil is the big one. In March 2018 we selected an average oil price for 2018 of $63.45 and $65 in 2019. As we were doing the work, oil prices had fallen sharply to $59, shouts of “lower for longer” were echoing through the streets, and our call for over $63 this year felt bold.

But as I type this in May 2018, WTI oil is getting friendly with $72, and crazy talk of $80 oil is appearing in the news.

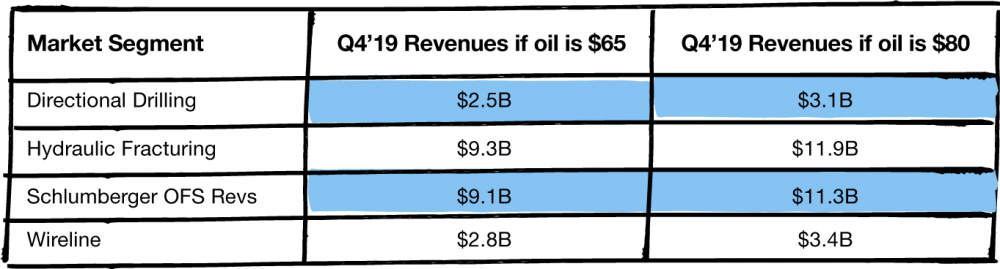

So, what is the impact of $80 oil next year on oilfield products and services? A lot. Consider the following table:

If the price of oil ends 2018 at $65 (West Texas Intermediate), then the Q4 2019 directional drilling market will stand at $2.5B worldwide, but if the price of oil is $80, the global directional market will be $3.1B, 25% higher than at $65.

If $65, the frac market will be $9.3B, but at $80, $11.9B, which is almost 30% higher (the highest quarter ever in hydraulic fracturing was $12B in Q4 2014).

Same with wireline logging, Schlumberger’s revenues, Halliburton’s revenues, and most everybody’s revenues.

June 1st we’ll release our newest forecast of drilling, which means we are wrestling with oil price outlooks again today while 2020 futures prices are below $60. I think we’ll be selecting an oil price for that window of time that is a full $20 higher.

Hold on to your hats.

PS. If the price of oil reaches $100 by the end of 2019, the Q4 2019 frac market will hit $15B, but don’t tell anybody.

PPS. Source of this analysis has been Spears’ proprietary Product Line Forecast.